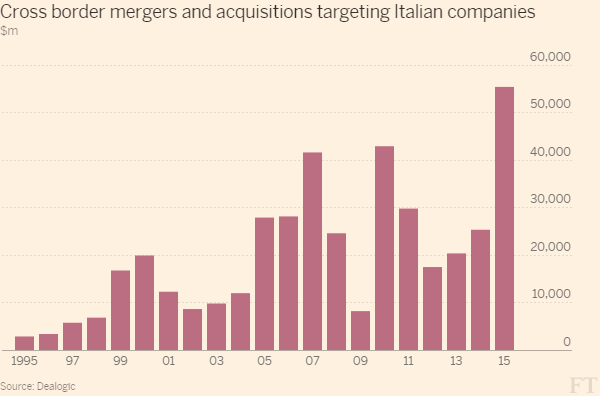

Record high merger and acquisition deals in Italy

The value of cross border merger and acquisition deals in Italy reached a new high in 2015 at over $50bn. Italian companies were the most targeted by foreign acquisitions in the European Union after the UK, along with France.

Some big deals, including the $9bn acquisition in March of the tyre-maker Pirelli by the Chinese company ChemChina contributed to the rise in capital invested last year, but the number of deals – at 248 – also pointed to an exceptional year.

Marco Simoni, one of the top economic advisers to the reformist Prime Minister Matteo Renzi, in an interview with the FT, described how a large part of the growth could be explained by a radical change in the political climate for foreign investors. “Back in 2008 politicians would campaign in favour of ‘Italian-only’ ownership, now the government is actively facilitating investments in the country”, said Mr Simoni. Initiatives include the introduction of government bodies and judiciary channels dedicated to foreign investors and specialists assigned to large investors to help them sort out possible difficulties. Confidence in a stable government has been another key factor in reassuring foreign investors.

A more favourable government attitude to foreign investors is confirmed by John Burton, Head of Development of Westfield UK/Europe that is opening a shopping centre in Milan. “It is a good coincidence for us that in this phase of our project we have a government in place that is willing to make this happen, not just in words but in action”. However, Westfield has been working on the project for about 5 years now and the decision to open in Milan resulted from an analytical analysis based on lots of parameters including population size, diversity, tourism, retail activity and the economic health of the broader region.

Greenfield investments – a form of direct investment where a parent company starts a new venture in a foreign country by constructing new operational facilities from the ground up – are also rising, but not as fast as acquisitions.

One third of cross border greenfield investments in Italy since 2014 were in manufacturing production, a sector that is strong in the country.

“Take the example of Philip Morris International” continues Dr. Simoni “they opted to open their most modern plant in Italy rather than pursuing any other option because of the availability of machinery and packaging firms in the area of Bologna (central Italy) and because, they said, problem-solving capacity of Italian workers is a global best practice”.

The rise of cross border greenfield investments seems set to continue this year with six deals announced in January alone. 40 per cent of the capital invested was in the south of the country and its islands, compared to an average of only 19 per cent in the eight years to 2015.

Among those projects there were HostGee.com, a subsidiary of Saudi Arabia-based Gulf Infonet that announced a data processing project in Palermo (Sicily) and Apple, who have opened a new iOS application development centre in Naples.

“ICT is a labour intensive industry and in the South of Italy you probably get the best cost competitiveness condition in the world for high skilled personnel” explains Dr. Simoni.

ICT and logistics constituted almost the totality of cross border greenfield investment in January this year and about 40 per cent last year. There were 25 Italian telecommunication companies involved in M&A deals last year, accounting for about one fifth of the total amount invested.

Greenfield ICT projects in January were estimated to create a few hundred jobs in the impoverished south where the unemployment rate is about double that of the national average, and where over half of the young people (aged 15 to 24 years old) are unemployed.

But there is not one single Italian sector that is not appealing to foreign investors, according to Guido Nola, co-senior country office at JP Morgan Italy and adviser on several larger deals last year.

Italy has been lagging behind in terms of attractiveness of FDI for more than a decade. It ranked 32nd globally by amount of cross-border greenfield capital invested in the last 14 years according to fDI Markets data and Italian companies were less targeted than Spanish ones for M&A deals in the seven years to 2014.

“I am glad of the news of the rise in mergers and acquisitions” concludes Dr. Simoni “a greater internationalization will help the firms to grow”. Italian entrepreneurs seem also more aware of the need to expand in terms of firm size and markets in order to compete in a globalized economy, according to Mr. Nola.

Foreign investments could be just what the country needs to escape from its structural low productivity and slow economic growth.

No comments:

Post a Comment