Lithium price on the rise

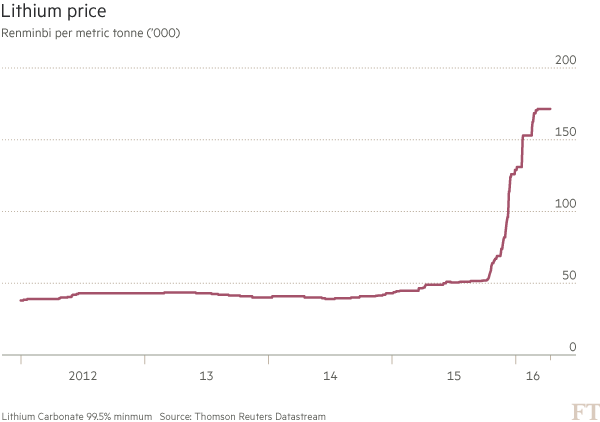

Commodities prices are generally falling but lithium spot price tripled in the past year, driven by demand for batteries used in electric cars and devices.

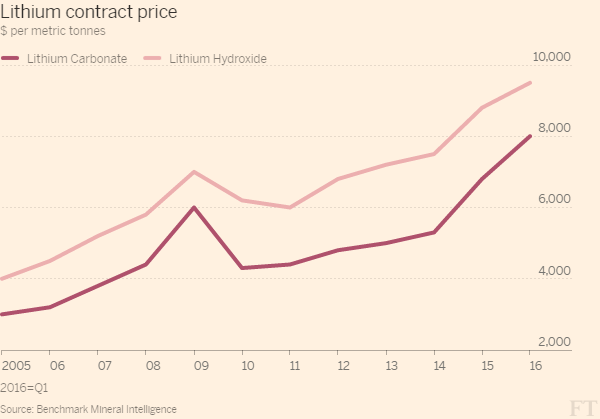

The price paid by companies for long-term contracts has presented a less dramatic rise than the spot Chinese lithium price, although lithium carbonate contract prices are still 50 per cent higher than in 2014.

Telsa, the car manufacturer, will contribute to the rising demand as it builds the largest battery plant in the world in Nevada, capable of producing up to 500,000 lithium-ion vehicle batteries per year. The plant is expected to produce finished battery packs from raw material by 2020.

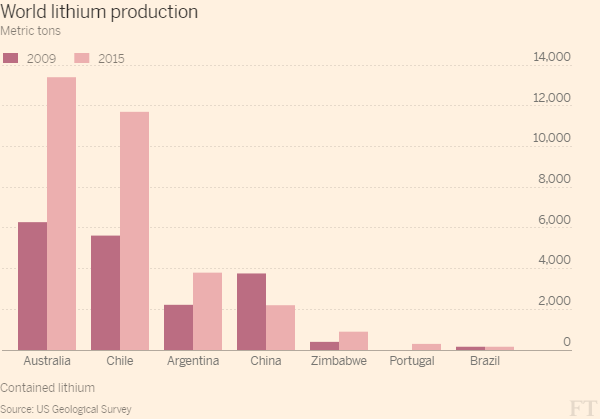

According to data from the US geological survey, most lithium production comes from Australia and Chile, where production more than doubled in the last six years, while production in Argentina increased by 17 per cent in the last year.

However, operations are also under development in Bolivia, the US, Canada, Finland, Serbia and Mexico.

Bolivia has the largest identified reserves in the yet undeveloped Salar de Uyuni, the largest salt flat in the world, where Chinese and German technologies are helping develop the country’s nascent industry.

However, due to its the dry-desert climate Chile is a better suited to lithium production especially in what is known as the “lithium triangle”, an area of high-altitude lakes across Chile, Argentina and Bolivia which accounts for over half of the world’s known reserves of lithium.

While Telsa makes the news, much of the demand comes from Asia. Thanks to its large electronic manufacturing production China is leading lithium consumption, tapping on its own production in Tibet as well as on imports. According to data from the International Trade Centre, China is the second largest importer of lithium carbonates after South Korea. Imports from both countries doubled in the last five years.

China and South Korea also attract the largest amount of foreign capital invested in lithium-related greenfield projects, those where a parent company starts a new venture in a foreign country by constructing new operational facilities from the ground up. In the last eight years they each attracted a total of $2bn, according to fDI Markets.

The government of South Korea partnered with several mining companies in order to secure stable long-term supplies of lithium for its expanding automobile, electronics and battery industries. Conversely, Japanese lithium carbonate consumption decreased largely because the move of battery manufacturing plants from Japan to China and Indonesia, according to the US Geological Survey.

Lithium is used as much in the production of ceramics and glass as it is in the production of batteries, but it’s the increasing reliance on the latter that underpins expectations of a “lithium revolution”. This has yet to happen, but the massive rise in lithium price suggests it is within reach.

No comments:

Post a Comment