Investments boom in renewable energies

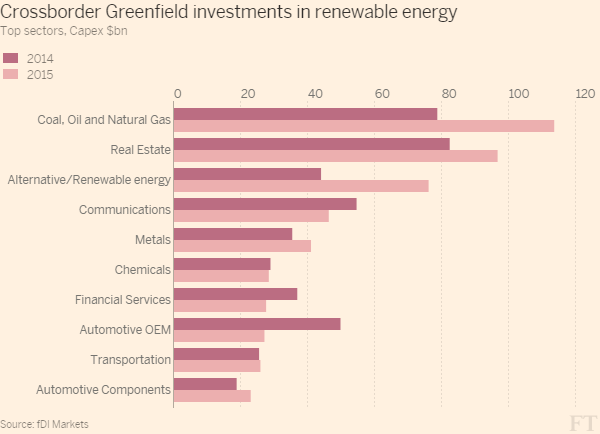

‘Greenfield’ FDI – crossborder investments in physical projects excluding M&A, increased by nine per cent last year, to $713bn. Oil and gas attracted the largest amount, followed by real estate, but the amount invested in renewable energy increased fastest, up 73% to $76bn, according to data from fDI Markets.

“We are in the middle of a renewable energy revolution”, says Adnan Amin, director-general of the International Renewable Energy Agency (IRENA) in an interview with the Financial Times. “For the last two years, more than half of net capacity additions globally were renewable”.

At the hearth of the revolution is the technological development that made renewable energy cost-competitive. “Solar module prices have dropped as much as 80% since 2009, and the more we build the less expensive it gets (..) Onshore wind is now one of the most competitive sources of electricity available” adds Mr. Amin.

China is largely responsible for this cost reduction, as it helped transform solar energy from a niche market in 2006 to the mass energy production industry of today, says Laszlo Varro, IEA’s Chief Economist. The country is now the largest PVmarket and has the largest wind power capacity in the world.

While the growth in renewable energy generation is stagnating in advanced countries, due to falling energy demand and overcapacity, continues Mr. Varro, it is developing quickly in emerging markets.

Prof. Dr. Ulf Moslener of Frankfurt School–UNEP Centre, in an interview with the FT points out that in the advanced countries relatively large shares of electricity generation come from volatile sources such as solar and wind. Most emerging markets don’t yet face this problem.

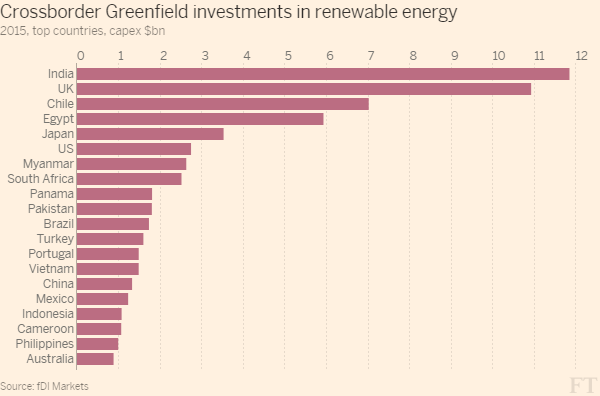

Developing countries attracted the majority of investments into renewable energy last year with India the most targeted country and Chile, Egypt, Myanmar and South Africa all featuring in the top eight destinations.

Both Mr. Varro and Mr. Amin highlight how some of the emerging markets are combining attractive solar or wind energy conditions and strong growth in the energy demand.

This is the case in Chile, with huge demand from the mining sector, Mexico, with expensive energy generation, and India, facing the challenges of supplying the huge rural population and satisfying demand due to rapid economic growth. “Sorting out the energy supply problem for India is a pre-condition for its program of industrialization” affirmed Mr. Varro. The rise in investments in India seem set to continue with the Singaporean Sembcorp Green Indra investing $1bn to develop a one gigawatt wind power facility in Madhya Pradesh.

However, renewable energy growth is not only a prerogative of emerging markets. The US is experiencing a solar boom and wind generation is strong in the UK. But Latin America is undoubtedly the fastest growing renewable energy market, states Mr. Amin.

In Chile and Uruguay FDI in renewable energy accounted for more than 70 per cent of all crossborder greenfield investments in the country last year. Both countries have extremely competitive renewable energy prices, and in Uruguay the 100 per cent of power generation comes from renewable energy.

Africa attracted a growing proportion of foreign investments, 17 per cent in the three years to 2015 compared to 5 per cent of the previous three years, but the picture is patchier than in Latin America.

Morocco is the most advanced country in terms of solar energy generation in the continent with the largest concentrating solar power (CSP) plant in the world, a different technology from PV, that generates electricity through using sunlight to heat fluid and make it easier to store heat. Morocco had $2bn of investments in 2014 that are now helping the country sustain its domestic industrialisation, and Morocco could soon become an energy exporter to Portugal, Spain and to the rest of Africa, according to Mr. Amin. Egypt was one of the top targeted countries last year for greenfield investments in renewable energy, but the industry is still in the stage of signing contracts.

Mr Amin thinks that many other African countries will not be able to attract similar levels of green investments if they don’t improve their policies, finance and technology.

The growth of renewable energy is expected to continue. The International Energy Agency forecast renewables to account for a third of electricity generation by 2040. Solar energy generation is expected to spread in Latin America, particularly Argentina and Colombia, and in South East Asia according to Mr. Amin.

This is good news for emerging markets. IRENA recently estimated that doubling the share of renewables would increase global direct and indirect employment in the sector from 9.2 million today to 24.4 million by 2030.

No comments:

Post a Comment